With an expensive domain name, robust regulatory compliance and excellent visibility, Markets.com has created a brokerage that attempts to unite the global financial markets under a single roof. The broker deals in a wide range of Forex and CFD products, and currently offers more than 2200 different financial instruments from major markets across the globe.

Read more ⬇

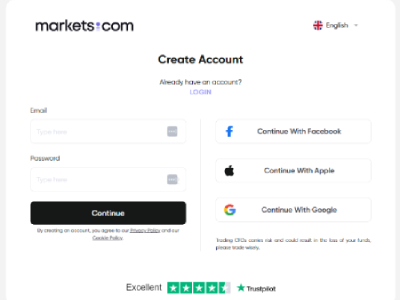

How To Sign Up And Claim The Markets.com Promotion

Opening a Markets.com account is required to access their promotional offers. The sign-up process is intuitive but involves detailed personal and financial disclosures. Simply click “Sign Up” or “Open an Account” on the site or app to begin the registration process.

You’ll need to provide information such as your address, employment, income, investment plans, and trading experience. After accepting the T&Cs, you’ll receive an email confirmation. Final verification involves uploading documents like your ID, utility bill, or bank statement.

A Brief Outline of the Markets.com Bonuses & Promotions

Markets.com offers fewer promotions than brokers like FBS, AVATrade, and HYCM. Strict regulatory compliance limits what’s available. However, international clients—particularly in South Africa and BVI—do have some bonus options.

Markets.com First Deposit Bonus

Through its FSCA-regulated South African division, Markets.com offers up to a 35% deposit bonus for deposits starting at $100. The maximum bonus is $3,500 for a $10,000 deposit. Bonus withdrawals require meeting a $10,000 trading volume per $1 bonus within 90 days.

Markets.com Rebates Program

Markets.com offers up to 5% rebates on spread costs, credited every 10 days. All traders are automatically enrolled. Abuse of this system through duplicate accounts or mirrored trades is prohibited under their fair use policy.

Switching Bonus

Switching from another broker to Markets.com may qualify you for up to a 35% deposit bonus (max $3,500). Terms mirror those of the standard deposit bonus, including the $10,000 trading volume per $1 credit requirement within 90 days.

Markets.com Refer-A-Friend Bonus

You can earn $50–$375 or trading credits up to $2,000 for each qualifying referral. The referred user must verify their account, deposit the required amount, and trade a set number of lots. Bonus eligibility is tiered:

- $100–$500 deposit + 5 lots traded = $50 or $250 in credits

- $500–$1000 deposit + 15 lots = $150 or $500 credits

- $1000–$2000 + 30 lots = $250 or $750 credits

- $2000+ + 50 lots = $375 or $2,000 credits

Markets.com Rewards Terms & Conditions

- Not available to residents of restricted countries like the US or India.

- Trading volume requirements must be met within 90 days.

- Only one reward allowed per household.

- Loss of total capital may void bonus withdrawals and freeze the account.

- Abuse through multiple accounts will lead to account action.

- Markets.com reserves all rights regarding its promotional offers.

Trading CFDs involves a high risk of capital loss. Proceed cautiously.

Benefits of Signing up for Markets.com Bonuses

Even without promotions, Markets.com is a trusted and regulated broker. Their limited bonus programs can still offer valuable incentives to international traders, though availability is region-specific due to regulatory limitations.